Introduction to BigData in Cryptocurrency BigData in cryptocurrency analyzes over 2.5 quintillion bytes of daily blockchain data to provide market insights and security measures. This massive data processing system handles 400,000+ Bitcoin transactions daily, monitors 20,000+ cryptocurrencies, and tracks millions of wallet addresses in real-time. Through advanced analytics, BigData systems process blockchain […]

Category: Blog

What is ODL (On-Demand Liquidity)?

.container-odl { max-width: 1200px; margin: 0 auto; padding: 20px; font-family: ‘Segoe UI’, system-ui, -apple-system, sans-serif; line-height: 1.6; color: #333; } .header-odl { text-align: center; margin-bottom: 40px; } .title-odl { font-size: 2.5rem; color: #2c3e50; margin-bottom: 20px; } .subtitle-odl { font-size: 1.2rem; color: #7f8c8d; } .section-odl { margin-bottom: 40px; padding: 20px; background: #fff; border-radius: 8px; box-shadow: 0 […]

How Many Pi Coins Are There?

Complete Guide to Pi Network’s Supply (2024) .picoins-container { font-family: ‘Segoe UI’, system-ui, -apple-system, sans-serif; max-width: 1200px; margin: 0 auto; padding: 20px; color: #2c3e50; } .picoins-header { text-align: center; margin-bottom: 40px; } .picoins-header h1 { font-size: 2.5rem; color: #1a237e; margin-bottom: 20px; } .picoins-section { margin-bottom: 40px; padding: 20px; background: #ffffff; border-radius: 8px; box-shadow: 0 2px […]

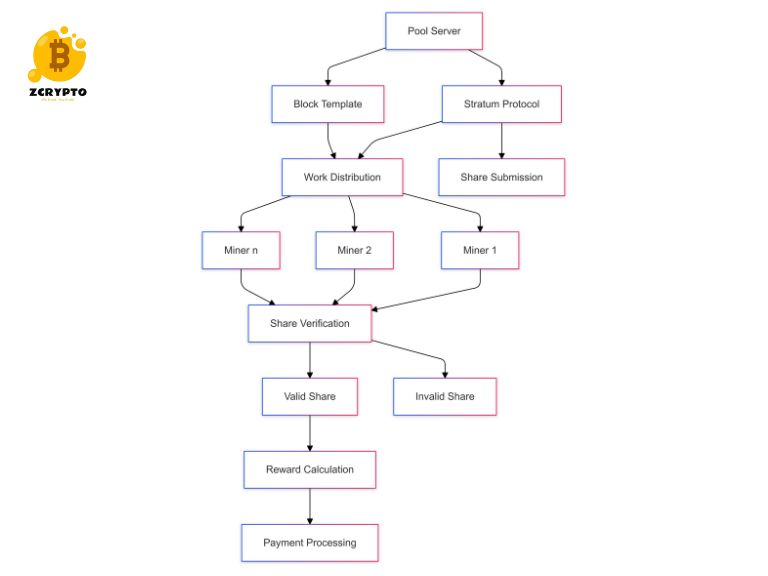

What is Mining Pool? A Technical Analysis of Collaborative Cryptocurrency Mining

Mining pools represent a critical infrastructure component in cryptocurrency networks, enabling multiple participants to combine their computational resources for more predictable block rewards. This technical analysis examines the core mechanisms, operational frameworks, and economic dynamics of mining pools in cryptocurrency networks. What is Mining Pool? A Technical Analysis of Collaborative Cryptocurrency Mining. Technical Architecture of […]

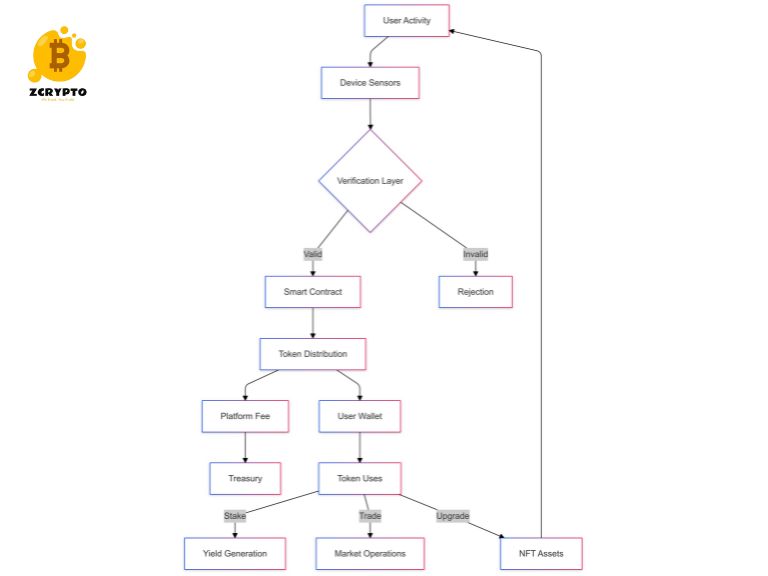

What is Move to Earn? A Technical Analysis of Performance-Based Cryptocurrency Rewards

Move to Earn (M2E) platforms operate through blockchain-based systems that link physical activity tracking with cryptocurrency rewards. These systems quantify user movement data through smartphone sensors and wearable devices, converting verified physical actions into token-based incentives. STEPN exemplifies this model with its GPS-tracked outdoor activities generating Green Satoshi Tokens (GST). Users must purchase NFT sneakers […]

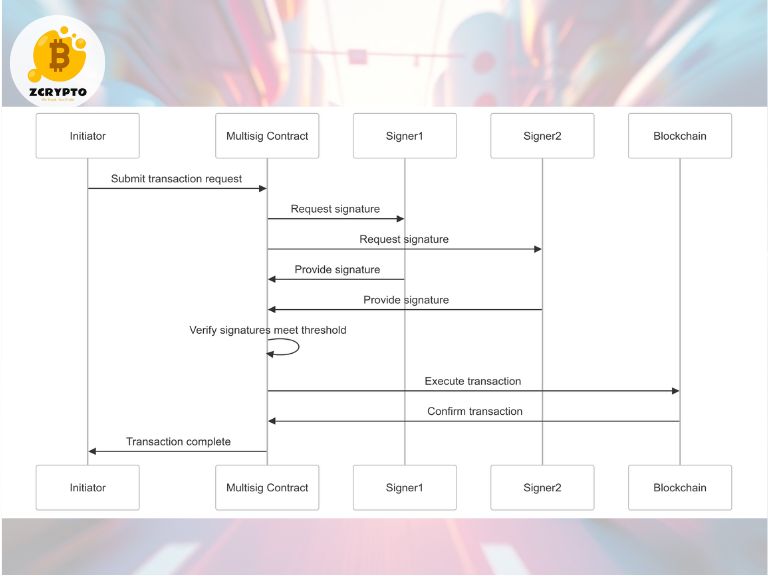

What is Multisig? A Technical Analysis of Multi-Signature Security

Multi-signature technology represents a critical security advancement in cryptocurrency management, requiring multiple private keys to authorize transactions. This article examines the technical implementation, security architecture, and practical applications of multisig systems. What is Multisig? A Technical Analysis of Multi-Signature Security. Technical Implementation of Multi-Signature Security Multi-signature protocols establish a collaborative transaction approval framework through cryptographic […]

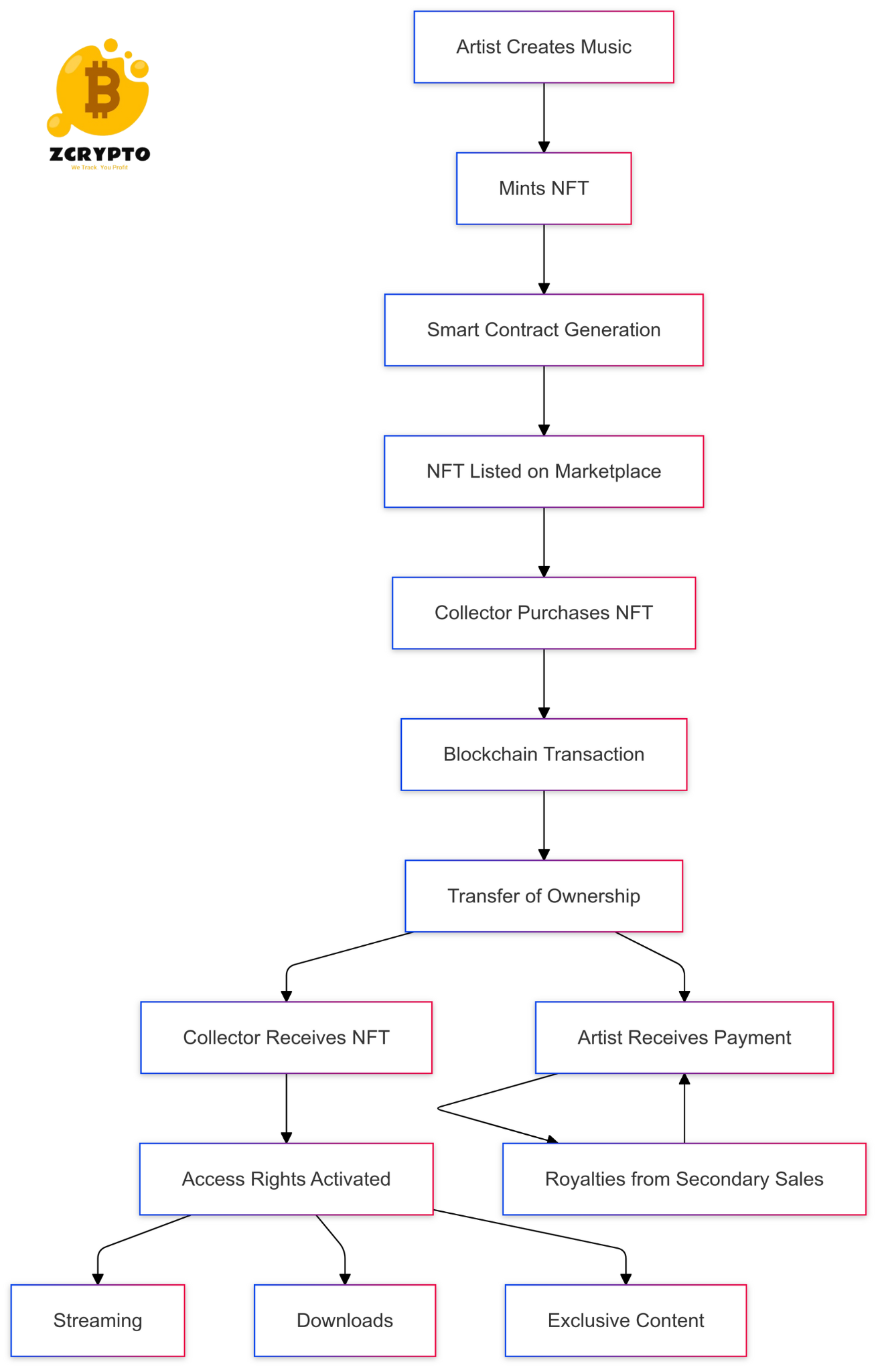

What is Music NFT? Transforming Artist-Fan Relationships

What is Music NFT? A Music NFT represents a unique digital certificate of ownership for musical content stored on a blockchain, enabling direct transactions between artists and fans while guaranteeing authenticity and scarcity. Music NFTs mark a substantial shift in how musical assets are owned, traded, and monetized. By creating verifiable scarcity and enabling programmable […]

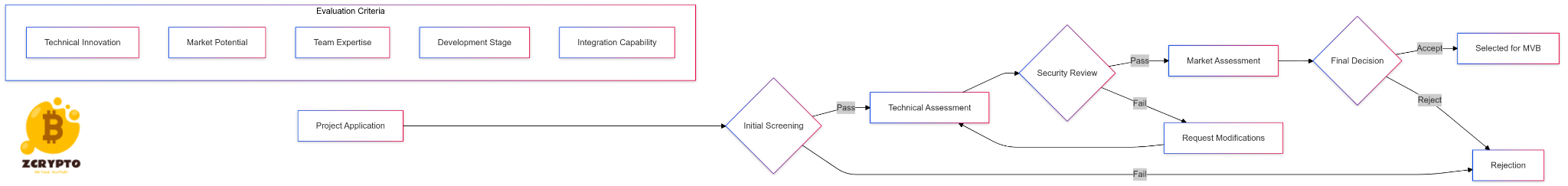

What is MVB Most Valuable Builder? A Comprehensive Guide to Binance’s Blockchain Innovation Program

The Most Valuable Builder (MVB) program represents a strategic initiative within the BNB Chain ecosystem, focusing on identifying and supporting promising blockchain projects. MVB serves as a catalyst for innovation, providing comprehensive support to developers building decentralized applications. This acceleration program bridges the gap between innovative blockchain concepts and successful deployment on the BNB Chain. […]

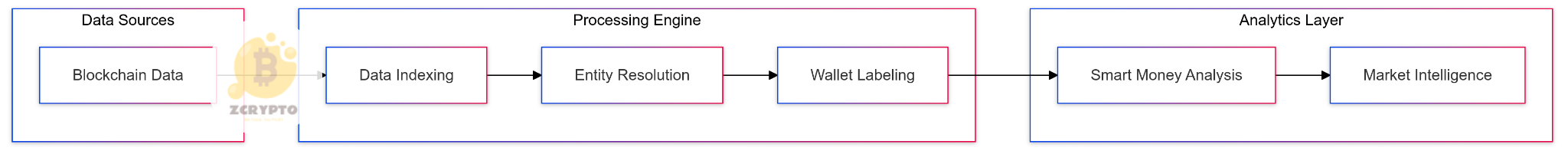

What is Nansen? Data Analytics Platform for Web3 Intelligence

What is Nansen? The platform serves as a blockchain analytics solution that processes on-chain data into accessible intelligence for cryptocurrency investors and institutions. This article examines Nansen’s capabilities, infrastructure, and applications in blockchain analysis. What is Nansen? Data Analytics Platform for Web3 Intelligence. Advanced Analytics Infrastructure Nansen indexes blockchain data across multiple networks including Ethereum, […]

What is NFT Marketplace? – ZCrypto

Quick Answer: An NFT marketplace is a digital platform that enables users to create, buy, sell, and trade non-fungible tokens (NFTs). Popular platforms like OpenSea and Rarible facilitate these transactions using blockchain technology, primarily on the Ethereum network. These marketplaces typically charge 2.5% commission per sale and require a crypto wallet for transactions. 🌐 Largest […]